Kabbage, Inc. is an online financing technology and data company based in Atlanta, Georgia. The company provides funding directly to small businesses and consumers through an automated lending platform.

History

Kabbage, Inc. was established in 2009 by Rob Frohwein, Marc Gorlin, and Kathryn Petralia. The financial services data and technology platform based out of Atlanta, Georgia, publicly launched and began making its first loans in May 2011.

Kabbage is venture funded and backed by Thomvest Ventures, Mohr Davidow Ventures, and BlueRun Ventures and is debt funded by Victory Park Capital. Additional investors include: David Bonderman, Warren Stephens, the UPS Strategic Enterprise Fund, TriplePoint Ventures, and Jim McKelvey.

In 2012, Kabbage opened its San Francisco office and appointed Victoria Treyger as Chief Marketing Officer. That same year, Kabbage raised $30 million in Series C financing, led by Thomvest Ventures, and was named one of Red Herring's Top 100 North American private companies.

In February 2013, the company expanded internationally, entering the United Kingdom, and was named one of the Top 10 Most Innovative Companies in Finance by Fast Company. Also in 2013, Kabbage raised $75 million in debt financing, led by Victory Park Capital and existing investor Thomvest Ventures.

In 2014, Kabbage raised an additional $106 million in funding from SoftBank Capital, TCW/Craton, Lumia Capital, the UPS Strategic Enterprise Fund, Thomvest Ventures, BlueRun Ventures and Mohr Davidow Ventures. In April 2014, Kabbage closed a $270 million credit facility from Guggenheim Securities, the investment banking and capital markets division of Guggenheim Partners. A BBB debt rating was obtained by Kabbage on $136 million of Class A notes that were part of the $270 million facility obtained from Guggenheim Securities.

As of August 2015, Kabbage was nearing $1 billion in working capital funded to small businesses and was named to Forbes Magazine's Top 100 Most Promising Companies for the second year in a row.

In October 2015, Kabbage completed a Series E funding round of $135 million led by Reverence Capital Partners. Holland's ING, Spain's Santander (via InnoVentures, Santander's venture capital arm); and Canada's Scotiabank also participated in the round. This latest funding values the company at over $1 billion.

How To Get Working Capital For Small Business Video

Product

Kabbage's small business product is a permanent line of credit up to $100,000, based on a number of data factors, including business volume, time in business, transaction volume, social media activity, and the seller's credit score. Kabbage developed "Social Klimbing" as a way to generate a Kabbage Score for its customers, which is utilized like a social media credit score. Kabbage customers typically utilize advances for working capital for equipment and inventory purchases.

Kabbage expanded its business-to-mobile operations with an iOS and Android app in November 2012. That December, Kabbage began leveraging Square transaction data to underwrite funding.

In February 2014, Kabbage began extending more than $1 million per day in funding. Within that same month, Kabbage expanded its product offering to lend to brick-and-mortar businesses. Prior to this, Kabbage was developed only to serve online businesses. The expansion also included increasing working capital lines from $50,000 to $100,000.

In September 2014, Kabbage, Inc. leveraged the same technology and data platform to launch its second brand, Karrot personal loans In that same month, Kabbage began lending $2 million per day to small businesses.

In March 2015, Kabbage began licensing its lending platform to power lending for organizations interested in providing financing to their customers, while extending $3 million in deployed capital per day.

Kabbage introduced the Kabbage Card in May of 2015, allowing businesses to pay for items at the point of sale with a purchasing card tied to their Kabbage account.

Partnerships

In February 2012, Kabbage and United Parcel Service entered into an agreement, allowing small businesses to share their shipping histories with Kabbage. Kabbage entered into a partnership with Intuit QuickBooks in Spring 2013 that enables QuickBooks users to link their QuickBooks account to qualify and access capital through Kabbage. Kabbage partnered with Stripe, a company that enables businesses to instantly accept credit card payments online, in August 2013 to underwrite customers based exclusively on Stripe's payment processing data. Kabbage also teamed up with Xero, a leader in online accounting software, to extend funding to Xero's customers by leveraging their online accounting data.

In March 2015, Kabbage launched its first platform lending partnership with Australia-based Kikka Capital to establish a new small business product powered entirely by Kabbage technology. Through this partnership, Kabbage provides the onboarding, underwriting, and monitoring technology platform, while Kikka Capital manages the operations, marketing funding, and loan servicing.

In May 2015, Sage Payment Solutions became the first third-party organization to leverage Kabbage's technology and data platform. Within that same year, Kabbage also established a partnership with MasterCard to allow Kabbage's data and technology platform to be available within their business network. In July 2015, Kabbage established a partnership with Experian, allowing Experian to leverage Kabbage's automated lending platform to its institutional clients serving small businesses and consumers.

Are You Looking for Products

Here some products related to "Kabbage".

Small Business Accounting..

Quicken Home and Business..

Swift Capital: Appstore f..

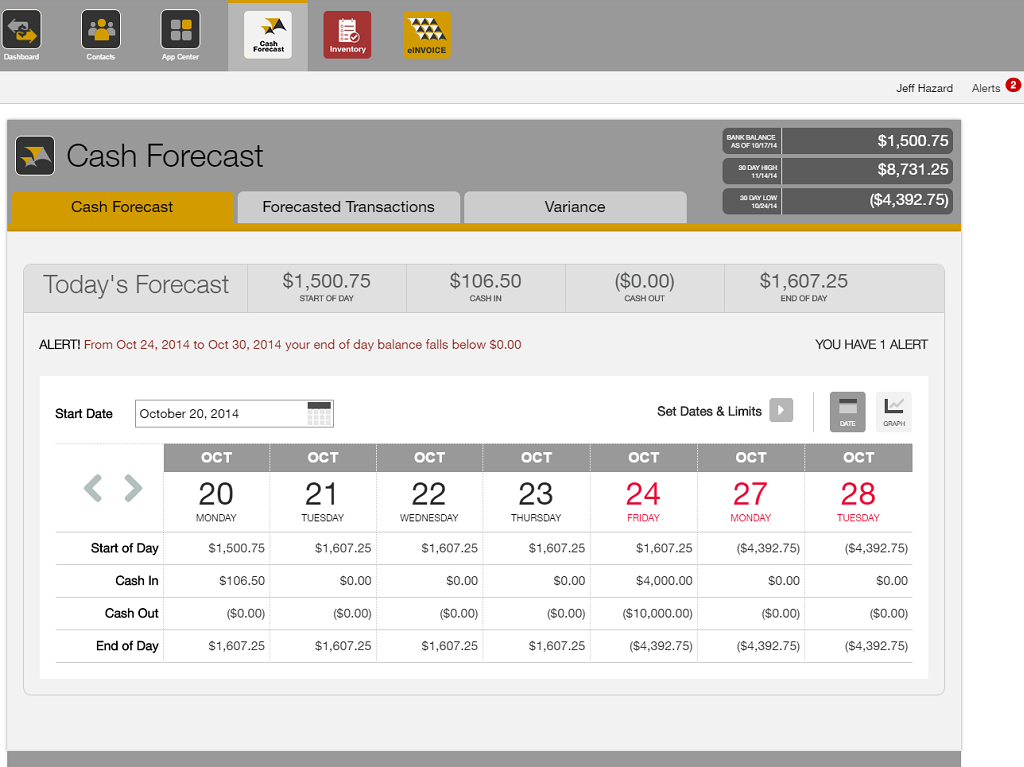

SBWorkbench Cash Forecast..

Get these at Amazon.com* amzn.to is official short URL for Amazon.com, provided by Bitly

Source of the article : here

![Amazon.com: Quicken Home and Business 2014 [Old Version]: Software Amazon.com: Quicken Home and Business 2014 [Old Version]: Software](https://images-na.ssl-images-amazon.com/images/G/01/aplus/detail-page/B00E6LJAOG_businesssnapshot_lg.jpg)

EmoticonEmoticon