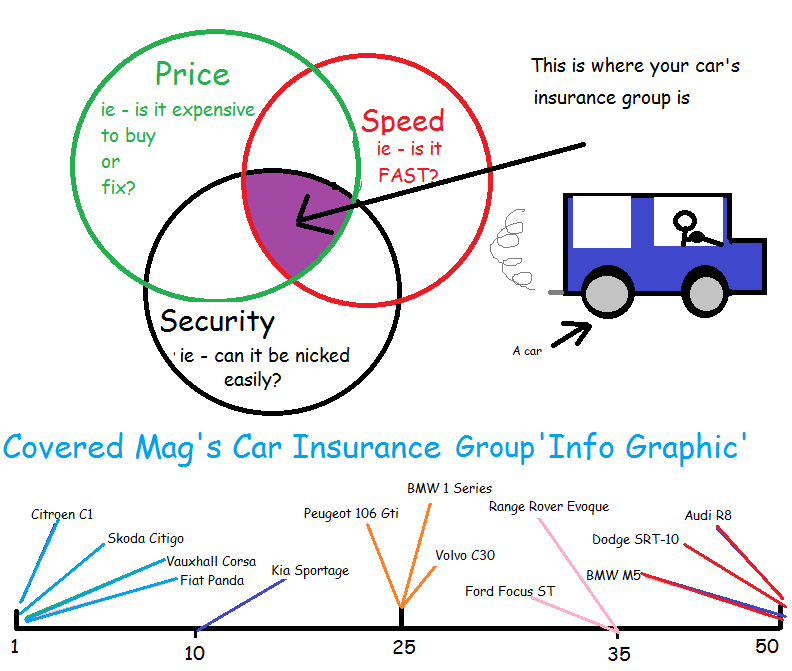

Usage-based insurance (UBI) also known as pay as you drive (PAYD) and pay how you drive (PHYD) and mile-based auto insurance is a type of vehicle insurance whereby the costs are dependent upon type of vehicle used, measured against time, distance, behavior and place.

This differs from traditional insurance, which attempts to differentiate and reward "safe" drivers, giving them lower premiums and/or a no-claims bonus. However, conventional differentiation is a reflection of history rather than present patterns of behaviour. This means that it may take a long time before safer (or more reckless) patterns of driving and changes in lifestyle feed through into premiums.

Concept

The simplest form of usage-based insurance bases the insurance costs simply on the number of miles driven. However, the general concept of pay as you drive includes any scheme where the insurance costs may depend not just on how much you drive but how, where, and when one drives.

Pay as you drive (PAYD) means that the insurance premium is calculated dynamically, typically according to the amount driven. There are three types of usage-based insurance:

- Coverage is based on the odometer reading of the vehicle.

- Coverage is based on mileage aggregated from GPS data, or the number of minutes the vehicle is being used as recorded by a vehicle-independent module transmitting data via cellphone or RF technology.

- Coverage is based on other data collected from the vehicle, including speed and time-of-day information, historic riskiness of the road, driving actions in addition to distance or time travelled.

The formula can be a simple function of the number of miles driven, or can vary according to the type of driving or the identity of the driver. Once the basic scheme is in place, it is possible to add further details, such as an extra risk premium if someone drives too long without a break, uses their mobile phone while driving, or travels at an excessive speed.

Telematic usage-based insurance (i.e. the latter two types, in which vehicle information is automatically transmitted to the system) provides a much more immediate feedback loop to the driver, by changing the cost of insurance dynamically with a change of risk. This means drivers have a stronger incentive to adopt safer practices. For example, if a commuter switches to public transport or to working at home, this immediately reduces the risk of rush hour accidents. With usage-based insurance, this reduction would be immediately reflected in the cost of car insurance for that month.

The smartphone as measurement probe for insurance telematics has been surveyed

How Fast Can You Get Car Insurance Video

Potential benefits

- Social and environmental benefits from more responsible and less unnecessary driving.

- Commercial benefits to the insurance company from better alignment of insurance with actual risk. Improved customer segmentation.

- Potential cost-savings for responsible customers.

- Technology that powers UBI/PAYD enables other vehicle-to-infrastructure solutions including drive-through payments, emergency road assistance, etc.

- More choice for consumers on type of car insurance available to buy.

- Social benefits from accessibility to affordable insurance for young drivers - rather than paying for irresponsible peers, with this type of insurance young drivers pay for how they drive.

- Higher-risk drivers pay most per use, thus have highest incentive to change driving patterns or get off the roads, leaving roads more safe.

- For telematic usage-based insurance: Continuous tracking of vehicle location enhances both personal security and vehicle security. The GPS technology could be used to trace the vehicle whereabouts following an accident, breakdown or theft.

- The same GPS technology can often be used to provide other (non insurance) benefits to consumers, e.g. satellite navigation.

- Gamification of the data encourages good driver behavior by comparison with other drivers.

Potential drawbacks

- Prepaid insurance (usage-based or not) charges for future rather than past risk, and inevitably predicts some drivers' risk imprecisely. For example, a distance-based system may not distinguish between highway, city street, or rural back road driving. (Premiums can vary by zone to minimise this effect.) A telematic system may charge a driver who speeds, but otherwise drives in a safe manner, more than a slower driver who changes lanes abruptly, or drives in an inattentive or careless manner.

- For usage pricing, driving habits must be documented, raising privacy concerns especially in the case of systems which use continuous GPS tracking of vehicles. Personal information such as where you drive may also be inferred using only data such as speed and distance driven.

Implementations

USA

Metromile

Metromile is a California-based insurance startup funded by New Enterprise Associates, Index Ventures, National General Insurance/Amtrust Financial, and other investors. It offers a driving app and a pay-per-mile insurance product using a device that connects to the OBD-II port of all automobiles built after 1996. Metromile does not use behavioral statistics like type of driving or time of day to price their insurance. They offer consumers a fixed base rate per month plus a per-mile-rate ranging from 2 to 11 cents per mile, taking into account all traditional insurance risk factors. Drivers who drive less than the average (10,000 miles a year) will tend to save.

Metromile allows users to opt out of GPS tracking, never sells consumer data to 3rd parties, and does not penalize consumers for behavioral driving habits. Metromile is currently licensed to sell auto insurance in California, Oregon, Washington, Virginia and Illinois (as of July 2015). More states are expected to roll out shortly.

Progressive

Snapshot is a car insurance program developed by Progressive Insurance in the United States. It is a voluntary, behavior-based insurance program that gives drivers a customized insurance rate based on how, how much, and when their car is driven. Snapshot is currently available in 46 states plus the District of Columbia. Because insurance is regulated at the state level, Snapshot is currently not available in Alaska, California, Hawaii, and North Carolina.

Driving data is transmitted to the company using an on-board telematic device. The device connects to a car's OnBoard Diagnostic (OBD-II) port (all automobiles built after 1996 have an OBD-II.) and transmits speed, time of day and number of miles the car is driven. Cars that are driven less often, in less risky ways and at less risky times of day can receive large discounts. Progressive has received patents on its methods and systems of implementing usage-based insurance and has licensed these methods and systems to other companies. Progressive has service marks pending on the terms Pay As You Drive and Pay How You Drive.

Allstate

Allstate announced on October 8, 2012 that it has expanded its usage-based auto insurance product, Drive Wise, to four additional states including New York and New Jersey.

As of October 2012 Drive Wise is currently available in: Colorado, Michigan, New Jersey, New York, Arizona, Illinois, and Ohio.

Allstate's usage-based insurance product, Drive Wise, gets installed into a car's onboard diagnostic port, near the steering column in most cars.

Allstate said its usage-based insurance measures things such as mileage, braking, speed, and time of day when a customer is driving. Using that data, Allstate calculates a driving discount for each customer using its telematics technology.

One of the big advantages with Drive Wise is that it can constantly provide feedback to the consumers for as long as they keep the device in the car.

Allstate's Drive Wise utilizes data from a monitoring device plugged into a car's onboard diagnostic port. Of the drivers earning a discount, the average savings is nearly 14 percent per vehicle. More than 10 percent of all new Allstate customers are opting to participate in this coverage.

Liberty Mutual Insurance

Onboard Advisor is a commercial lines pay-how-you-drive, PHYD, or "safety-driven" insurance product by Liberty Mutual Agency Corporation. It offers up to 40% discount to commercial and private fleets based on how safely they actually drive.

National General Insurance

National General Insurance is one of the first and largest auto insurance companies to institute a Pay-As-You-Drive (PAYD) program in the United States back in 2004. The National General Insurance Low-Mileage Discount is an innovative program offered to OnStar subscribers in 34 states, where those who drive less pay less on their auto insurance.

This opt-in program is the first of its kind leveraging state-of-the-art technology using OnStar to allow customers who drive fewer miles to benefit from substantial savings. Eligible active OnStar subscribers sign up to save on their premiums if they drive less than 15,000 miles annually. Subscribers who drive even less than that can save even more (up to 54%).

Under the program, new National General Insurance customers receive an automatic insurance discount of approximately 26 percent upon enrollment (existing OnStar customers receive a discount based on historical mileage).

With the subscriber's permission, the odometer reading from his or her monthly OnStar Vehicle Diagnostics report is forwarded to National General Insurance. Based on those readings, the company will decrease the premium using discount tiers corresponding to miles driven.

Information sent from OnStar to National General Insurance pertains solely to mileage, and no additional data is gathered or used for any purpose other than to help manage transportation costs. Customers who drive more than 15,000 miles per year are not penalized and all OnStar customers receive an insurance discount simply for having an active OnStar subscription.

Japan

AIOI

AIOI introduced a Pay as You Drive insurance product in Japan in 2005. They partnered with Toyota to develop the technology. The technology is based on Toyota's G-Book terminals.

Australia

Real Insurance

Pay As You Drive is the world's first trust-based product developed in Australia by Real Insurance[10]. It solves a number of the problems that especially location based solutions face, particularly privacy issues and variable premiums. Customers pay a minimum premium, and then pre-pay for kilometers.

QBE

Insurance Box is the first telemetry-based insurance system in Australia, and uses telemetry from a device plugged into the vehicle's OBD II port. The telemetry is used to rate driver behavior, and provide this via a "DriveScore" to the insured. Premiums are adjusted annually. <http://www.qbe.com.au/Personal/Insurance-Box/Insurance.html>

EU

Direct Line Group in the UK (which holds policies for 20% of the UK registered vehicles) has released a series of telematics products to observe driver behaviour offering 20% discounts to end users. Mapfre and Generali offer their Pay as you go policies in Spain since 2007, primarily for 18-30 years clients.

IRIS

The International Research and Intelligent Systems Global (IRIS) company's Pay As You Drive and Fleet Risk Management products won Strategic Risk magazine's "European Risk Management Product of the Year 2008". These products are currently under evaluation by two major insurance companies. IRIS is located in Coventry, United Kingdom.

Tests

A number of tests of telematic auto insurance are currently underway or recently completed. These tests are being conducted in many different countries. They include:

- King County, Washington, United States: 5000 person trial by Unigard Insurance with US$1.9 million in federal funding

- Sweden, 250 000 km trial during 2013 using the smartphone as sensor by the insurer If.

Patents

There are several issued patents and pending patent applications that have been filed worldwide on various inventions related to telematic auto insurance. These include:

- EP 0700009 "Individual evaluation system for motorcar risk"

- US 5797134 "Motor vehicle monitoring system for determining a cost of insurance" Progressive auto insurance

- JP application 2002259708 "Vehicular Insurance Bill Calculating System, On-Vehicle Device, and Server Device", Toyota

- WO application 2005083605 "Insurance Fee Calculation Device, Insurance Fee Calculation Program, Insurance Fee Calculation Method, and Insurance Fee Calculation System", AIOI Insurance Company.

In order to make sure that patents did not hinder its Pay as You Drive development program, Norwich Union purchased the UK version of EP0700009 and obtained an exclusive license to any EU patents that may emerge from Progressive's EU patent applications.

In June 2010, Progressive Auto Insurance filed a patent infringement lawsuit against Liberty Mutual over one of Progressive's Pay As You Drive auto insurance patents.

In September 2010 Progressive Auto Insurance filed a declaratory judgment lawsuit against Hughes Telematics to have several its patents covering OBDII mounted wireless data loggers declared invalid. Progressive uses these devices from a competitive supplier, Xirgo Technologies.

Impaired driving

Telematics have been proposed or utilised in order to detect distracted driving. The use of telematics to detect drunk driving and Texting while driving has been proposed. A US patent application combining this technology with a usage based insurance product was open for public comment on peer to patent.

Are You Looking for Products

Here some products related to "Usage-based Insurance".

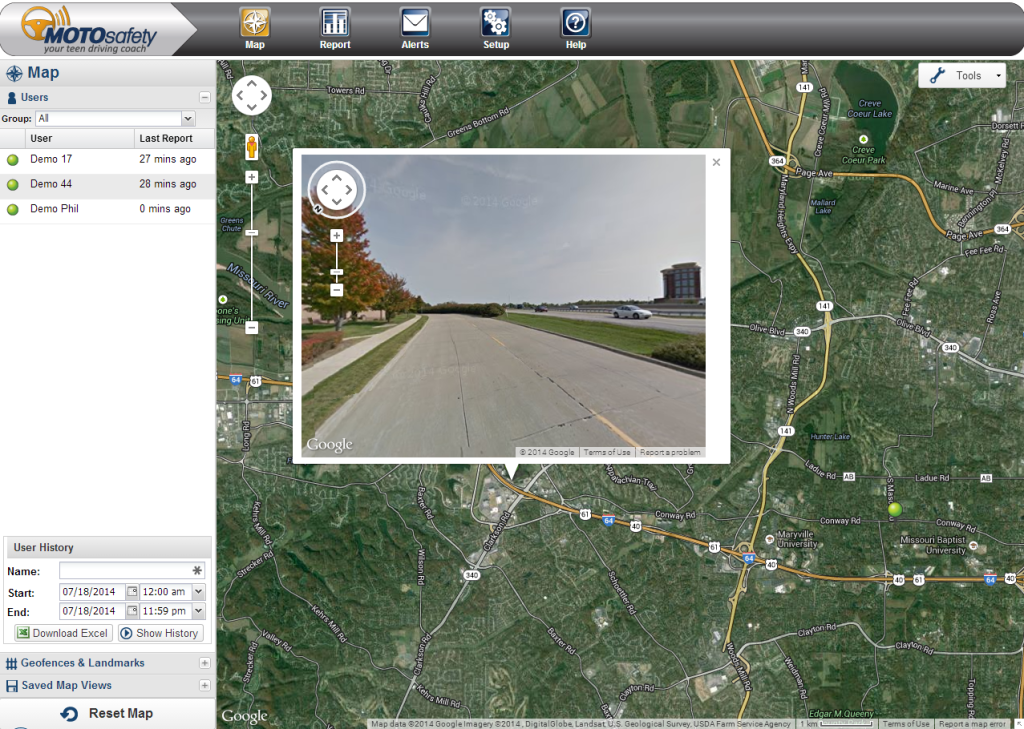

MotoSafety MPVAS1 Teen Sa..

MotoSafety MPVAS1 Teen Sa..

How to Live Well Without ..

How to Live Well Without ..

Get these at Amazon.com* amzn.to is official short URL for Amazon.com, provided by Bitly

Source of the article : here

EmoticonEmoticon